Last Updated: July 10, 2025 at 5:21 pm

Every year, thousands of banking aspirants find themselves caught between two crucial decisions: Should they go for IBPS PO or SBI PO? Both positions offer excellent career opportunities in the banking sector, but understanding the key differences can help you make an informed choice that aligns with your career goals and aspirations.

If you’re one of those candidates wondering about the difference between IBPS PO and SBI PO, you’ve come to the right place. This comprehensive guide breaks down every aspect of both positions, from salary structures to career growth prospects, helping you decide which path suits your ambitions better.

What is IBPS PO and SBI PO?

IBPS PO (Institute of Banking Personnel Selection – Probationary Officer)

IBPS PO is a common recruitment process that selects candidates for Probationary Officer positions across 20 participating public sector banks. These include Punjab National Bank, Bank of Baroda, Canara Bank, Union Bank of India, and many others. The Institute of Banking Personnel Selection conducts this exam annually to fill thousands of PO positions across different banks.

SBI PO (State Bank of India – Probationary Officer)

SBI PO is a dedicated recruitment process exclusively for the State Bank of India, India’s largest public sector bank. The State Bank of India conducts its own recruitment process to select candidates for Probationary Officer positions within the organization.

IBPS PO vs SBI PO Salary and Perks: A Detailed Comparison

IBPS PO Salary Structure 2025

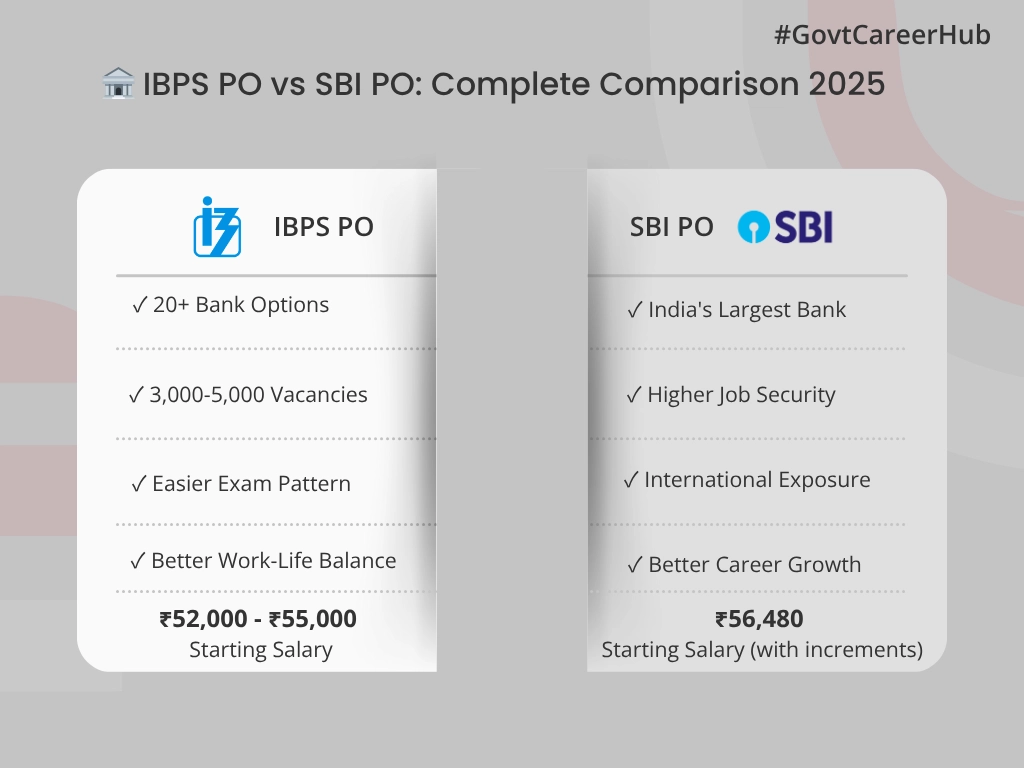

The starting salary for IBPS PO ranges between Rs. 52,000 to Rs. 55,000, with the gross salary going up to Rs. 90,732.77. Here’s the detailed breakdown:

Basic Salary Components:

- Basic Pay: Rs. 48,480 (as per 11th Bipartite Settlement)

- Special Allowance: Rs. 7,000

- Dearness Allowance: Variable (currently around 17.95% of basic pay)

- House Rent Allowance: 8.5% to 9.5% of basic pay (depends on location)

- City Compensatory Allowance: Rs. 600 to Rs. 1,200

Additional Perks:

- Medical benefits for self and family

- Provident Fund contribution

- Pension scheme

- Leave Travel Concession

- Subsidised loans for car and home

SBI PO Salary Structure 2025

The initial basic salary for SBI PO is Rs. 56,480 (Rs. 48,480 + advanced increments), with steady salary growth over time. Here’s what you can expect:

Basic Salary Components:

- Basic Pay: Rs. 48,480 + 4 advanced increments

- Special Allowance: Rs. 7,000

- Dearness Allowance: Variable (currently around 17.95% of basic pay)

- House Rent Allowance: 8.5% to 9.5% of basic pay

- City Compensatory Allowance: Rs. 600 to Rs. 1,200

Additional Perks:

- Medical insurance coverage

- Pension benefits

- Home and car loan facilities at subsidised rates

- Leave encashment

- Performance-based incentives

Winner: SBI PO

SBI PO offers slightly higher starting salary due to advanced increments and better structured allowances.

Exam Difficulty: IBPS PO vs SBI PO Which is Easy?

IBPS PO Exam Pattern and Difficulty

The IBPS PO exam consists of three stages:

- Preliminary Examination (100 marks)

- Main Examination (200 marks)

- Interview (30 marks)

Difficulty Level:

- Moderate to high difficulty

- Questions are mostly conventional with some new pattern questions

- Sectional and overall cut-offs are generally manageable

- Competition is high but distributed across multiple banks

SBI PO Exam Pattern and Difficulty

The SBI PO exam also has three stages:

- Preliminary Examination (100 marks)

- Main Examination (200 marks)

- Group Exercise & Interview (50 marks)

Difficulty Level: The SBI PO exam is tougher compared to the IBPS PO exam, with more new pattern questions that students might find difficult. Key factors making it tougher:

- More experimental and unconventional questions

- Higher cut-off marks due to limited vacancies

- Group Exercise adds an extra layer of assessment

- Intense competition for fewer positions

Winner: IBPS PO

IBPS PO is relatively easier to crack due to conventional question patterns and higher number of vacancies.

Career Growth and Promotion Prospects

IBPS PO Career Progression

Typical Career Path:

- Probationary Officer (Scale I) → Assistant General Manager (Scale II) → Deputy General Manager (Scale III) → General Manager (Scale IV) → Chief General Manager (Scale V)

Promotion Timeline:

- Scale I to Scale II: 2-3 years

- Scale II to Scale III: 3-5 years

- Further promotions: 5-7 years interval

Growth Opportunities:

- Opportunity to work in different banks

- Exposure to various banking operations

- Faster promotions in smaller banks

- Specialisation opportunities in different domains

SBI PO Career Progression

Typical Career Path:

- Probationary Officer (JMGS-I) → Assistant General Manager (MMGS-II) → Deputy General Manager (MMGS-III) → General Manager (MMGS-IV) → Deputy Managing Director (SMGS-V)

Promotion Timeline:

- JMGS-I to MMGS-II: 2-3 years

- MMGS-II to MMGS-III: 4-5 years

- Further promotions: 5-8 years interval

Growth Opportunities:

- Exposure to diverse banking operations

- International posting opportunities

- Leadership roles in India’s largest bank

- Specialisation in corporate banking, investment banking, etc.

Winner: SBI PO

SBI offers better long-term career prospects with international exposure and leadership opportunities.

Work Environment and Job Security

IBPS PO Work Environment

Pros:

- Option to choose preferred bank and location

- Diverse work culture across different banks

- Less work pressure in smaller banks

- Better work-life balance in certain banks

Cons:

- Work culture varies significantly between banks

- Some banks may have outdated systems

- Limited international exposure

- Transfer policies differ across banks

SBI PO Work Environment

Pros:

- Professional work environment

- Modern banking technology and systems

- Better infrastructure and facilities

- Strong brand reputation

Cons:

- High work pressure and targets

- Frequent transfers across the country

- Longer working hours

- Competitive internal environment

Winner: IBPS PO

IBPS PO generally offers better work-life balance and flexibility in choosing work location.

Also Read: SSC CGL vs Bank PO: Which is Tough? A Complete Comparison for Aspirants

Job Security and Stability

Both IBPS PO and SBI PO offer excellent job security as they are government sector positions with permanent employment status. However, there are subtle differences:

IBPS PO Job Security

- Permanent employment with participating banks

- Job security depends on the financial health of the assigned bank

- Recent bank mergers have created some uncertainty

- Overall stability remains high

SBI PO Job Security

- Employment with India’s largest and most stable bank

- Highest level of job security in the banking sector

- Strong government backing and support

- Minimal risk of organisational changes

Winner: SBI PO

SBI PO offers superior job security due to the bank’s market position and stability.

Also Read: Tips to Reduce Stress During Exams: A Student’s Guide to Staying Calm and Focused

Selection Process and Vacancies

IBPS PO Selection Process

- Vacancies: Usually 3,000-5,000 positions annually

- Selection Ratio: Approximately 1:200 to 1:300

- Process Duration: 4-6 months

- Bank Allocation: Based on preference and performance

SBI PO Selection Process

- Vacancies: Usually 1,500-2,000 positions annually

- Selection Ratio: Approximately 1:500 to 1:700

- Process Duration: 3-5 months

- Direct Appointment: Straight selection into SBI

Winner: IBPS PO

IBPS PO offers more vacancies and better selection chances.

Also Read: How to Reduce Stress and Anxiety During Exams: Best-8 Practical Ways

Quick Comparison Table: IBPS PO vs SBI PO

| Aspect | IBPS PO | SBI PO |

| Starting Salary | Rs. 52,000 – Rs. 55,000 | Rs. 56,480 (with advanced increments) |

| Exam Difficulty | Moderate | High |

| Annual Vacancies | 3,000 – 5,000 | 1,500 – 2,000 |

| Selection Ratio | 1:200 to 1:300 | 1:500 to 1:700 |

| Career Growth | Good | Excellent |

| Work Pressure | Moderate | High |

| Job Security | High | Very High |

| Transfer Frequency | Varies by bank | Frequent |

| International Exposure | Limited | Available |

| Bank Options | 20+ participating banks | SBI only |

SBI PO vs IBPS PO: Which is Better?

After analysing all aspects, here’s our verdict:

Choose SBI PO if:

- You want higher starting salary and better perks

- Long-term career growth is your priority

- You’re comfortable with challenging work environment

- Job security is your primary concern

- You don’t mind frequent transfers

Choose IBPS PO if:

- You prefer easier exam preparation

- Work-life balance is important to you

- You want more job opportunities (higher vacancies)

- You prefer choosing your preferred bank

- You’re looking for quicker selection process

Preparation Strategy: IBPS PO vs SBI PO

Common Preparation Approach

Both exams require similar preparation strategy:

- Quantitative Aptitude: Focus on arithmetic, algebra, and data interpretation

- Reasoning Ability: Practice logical reasoning and puzzles

- English Language: Improve vocabulary and comprehension skills

- General Awareness: Stay updated with current affairs and banking knowledge

- Computer Knowledge: Basic computer and internet concepts

Specific Preparation Tips

For IBPS PO:

- Practice more conventional question types

- Focus on speed and accuracy

- Solve previous years’ papers extensively

- Take mock tests regularly

For SBI PO:

- Prepare for new pattern questions

- Practice innovative problem-solving techniques

- Focus on Group Exercise preparation

- Develop analytical and presentation skills

Final Verdict

Both IBPS PO and SBI PO are excellent career options in the banking sector. Your choice should depend on your personal preferences, career goals, and circumstances.

If you’re looking for immediate opportunities and better work-life balance, IBPS PO is the way to go. However, if you’re ambitious about long-term career growth and don’t mind the challenges, SBI PO offers superior prospects.

Remember, success in either exam requires dedicated preparation, consistent practice, and strong determination. Choose the path that aligns with your goals and start preparing with full commitment.

The banking sector offers immense opportunities for growth and contribution to the nation’s economy. Whether you choose IBPS PO or SBI PO, you’re embarking on a rewarding career journey that promises stability, growth, and societal impact.

Frequently Asked Questions (FAQs)

Important Resources and Links

Banking Exam Preparation Resources:

- IBPS Official Website – Latest notifications and exam updates

- SBI Official Website – SBI career opportunities and announcements

- Reserve Bank of India – Banking sector updates and regulations

- Banking Awareness Current Affairs – Daily banking updates

Government Career Resources:

- UPSC Official Website – For civil services aspirants

- SSC Official Website – Staff Selection Commission exams

- Railway Recruitment Boards – Railway job opportunities

Internal Resources from GovtCareerHub:

- Complete Banking Exam Guide – Comprehensive preparation strategies

- Government Job Preparation Tips – Expert guidance for success

- Banking Sector Salary Guide – Detailed salary information

- Interview Preparation for Banking Jobs – Ace your banking interviews

Looking for more banking career guidance? Visit our comprehensive guides on other banking exams and preparation strategies to accelerate your success in the banking sector.