Banking Exams After BSc Agriculture: Your Gateway to a Rewarding Financial Career

Last Updated: August 4, 2025 at 10:25 pm

If you’ve just completed your BSc Agriculture degree, you might be wondering about the diverse career paths available beyond traditional farming or agricultural research. One of the most promising and lucrative options is pursuing a career in banking, specifically through specialised banking exams designed for agriculture graduates.

The banking sector actively seeks professionals with agricultural backgrounds to bridge the gap between financial services and rural communities. Your deep understanding of agricultural practices, rural economics, and farming challenges makes you an invaluable asset in roles focused on agricultural financing and rural development.

This comprehensive guide will walk you through the most relevant banking exams after BSc Agriculture, helping you make an informed decision about your career trajectory.

- Why Banking After BSc Agriculture Makes Perfect Sense

- Top Banking Exams for BSc Agriculture Graduates

- Detailed Exam Analysis

- Comprehensive Exam Preparation Strategy

- Career Growth and Salary Prospects

- Success Stories: Real Examples

- Overcoming Common Challenges

- Government Exams for Agriculture Graduates Beyond Banking

- Latest Trends in Agricultural Banking

- Frequently Asked Questions (FAQs)

- Your Next Steps: Action Plan

- Conclusion: Your Banking Career Awaits

Why Banking After BSc Agriculture Makes Perfect Sense

Agriculture graduates bring unique value to the banking sector, particularly in roles that require understanding of:

- Agricultural loan assessment and risk evaluation

- Rural market dynamics and seasonal farming patterns

- Government schemes and subsidies for farmers

- Crop insurance and agricultural finance products

- Rural development initiatives and microfinance

Banks actively recruit agriculture graduates for positions that involve direct interaction with farmers, rural entrepreneurs, and agricultural cooperatives. This creates a perfect synergy between your educational background and professional requirements.

Top Banking Exams for BSc Agriculture Graduates

Here’s a comprehensive comparison of the most relevant banking exams for agriculture graduates:

| Exam | Conducting Body | Eligibility | Age Limit | Key Highlights |

|---|---|---|---|---|

| IBPS AFO | IBPS | BSc Agriculture/Horticulture/Animal Husbandry | 20-30 years | Direct recruitment for Agricultural Field Officer |

| NABARD Grade A | NABARD | Bachelor’s in Agriculture/Allied fields | 21-30 years | Policy-level positions in rural development |

| IBPS PO | IBPS | Any Graduate | 20-30 years | General banking with agricultural lending focus |

| IBPS RRB Officer Scale I | IBPS | BSc Agriculture preferred | 18-30 years | Rural banking specialization |

| SBI Specialist Officer | SBI | BSc Agriculture/Allied fields | 21-30 years | Agricultural banking specialist roles |

Detailed Exam Analysis

IBPS Agricultural Field Officer (AFO)

The IBPS AFO exam is specifically designed for agriculture graduates and represents one of the most direct career paths in banking after BSc Agriculture.

Key Features:

- Direct recruitment for Agricultural Field Officer positions

- Specialized role focusing on agricultural lending

- Opportunity to work directly with farming communities

- Average starting salary: ₹4.7-5.2 LPA

Exam Pattern:

- Preliminary Exam: Reasoning, Quantitative Aptitude, English Language

- Main Exam: Professional Knowledge (Agriculture), General Awareness, English Language, Reasoning, Quantitative Aptitude

Professional Knowledge Syllabus includes:

- Crop production and management

- Soil science and fertility management

- Plant protection and pest management

- Agricultural marketing and economics

- Government schemes and rural development

NABARD Grade A Assistant Manager

NABARD specifically seeks agriculture graduates for policy-level positions in rural development and agricultural finance.

Why It’s Perfect for Agriculture Graduates:

- Direct involvement in policy formulation for rural development

- Higher starting salary compared to other banking exams

- Opportunity to work on national-level agricultural projects

- Clear career progression to senior management roles

Career Growth Path:

- Assistant Manager → Deputy General Manager → General Manager → Executive Director

Average Salary Progression:

- Assistant Manager: ₹6.5-7.2 LPA

- Deputy General Manager: ₹12-15 LPA

- General Manager: ₹18-22 LPA

Visit the NABARD career official website career page.

IBPS Probationary Officer (PO)

While open to all graduates, the IBPS PO exam offers excellent opportunities for agriculture graduates, especially in rural and semi-urban branches.

Advantages for Agriculture Graduates:

- Preference for rural postings where agricultural knowledge is valuable

- Opportunity to specialize in agricultural lending

- Faster career growth due to domain expertise

- Average starting salary: ₹7.8 LPA

IBPS RRB Officer Scale I

Regional Rural Banks specifically focus on rural areas, making this exam highly relevant for agriculture graduates.

Special Features:

- Exclusively rural banking focus

- Direct interaction with farming communities

- Knowledge of local agricultural practices highly valued

- Work-life balance in smaller towns and rural areas

Read Also: Govt Jobs After BSc Agriculture: Salary, Career Options & Scope

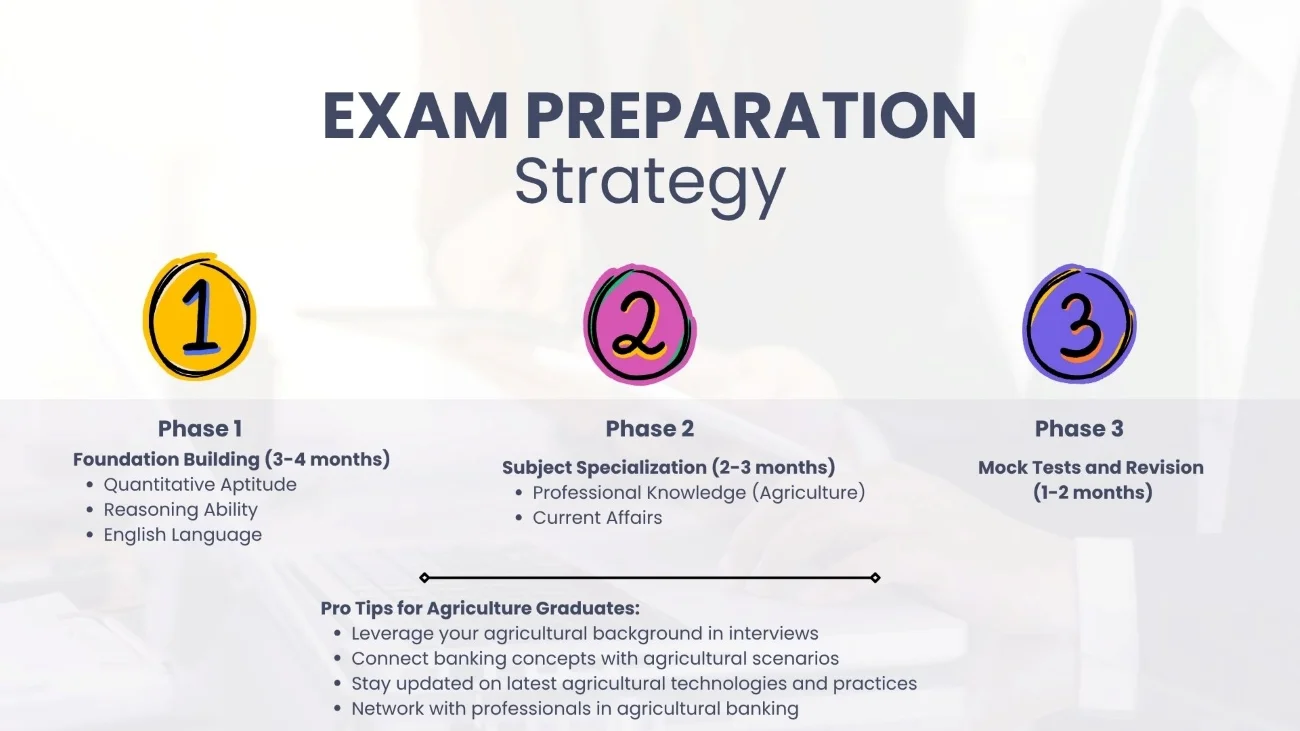

Comprehensive Exam Preparation Strategy

Phase 1: Foundation Building (3-4 months)

Quantitative Aptitude:

- Focus on basic arithmetic and data interpretation

- Practice percentage, ratio, and profit-loss problems

- Master time and work, time and distance concepts

Reasoning Ability:

- Strengthen logical reasoning and puzzles

- Practice seating arrangement and blood relation problems

- Focus on coding-decoding and direction sense

English Language:

- Improve reading comprehension skills

- Practice error detection and sentence correction

- Build vocabulary through daily reading

Phase 2: Subject Specialization (2-3 months)

Professional Knowledge (Agriculture):

- Revise core subjects from your BSc curriculum

- Focus on current developments in agriculture

- Study government schemes and rural development programs

- Practice previous years’ agriculture-related questions

Current Affairs:

- Daily reading of agricultural news and updates

- Follow RBI policies and banking news

- Stay updated on government initiatives for farmers

Phase 3: Mock Tests and Revision (1-2 months)

- Take regular mock tests to assess preparation level

- Analyze weak areas and focus on improvement

- Practice time management techniques

- Revise important formulas and concepts

Pro Tips for Agriculture Graduates:

- Leverage your agricultural background in interviews

- Connect banking concepts with agricultural scenarios

- Stay updated on latest agricultural technologies and practices

- Network with professionals in agricultural banking

Career Growth and Salary Prospects

The banking sector offers excellent career growth opportunities for agriculture graduates:

Entry-Level Positions:

- Agricultural Field Officer: ₹4.7-5.2 LPA

- Probationary Officer: ₹7.8-8.5 LPA

- RRB Officer Scale I: ₹2.9-3.5 LPA

- NABARD Assistant Manager: ₹6.5-7.2 LPA

Mid-Level Positions (5-10 years experience):

- Assistant General Manager: ₹12-15 LPA

- Deputy General Manager: ₹15-18 LPA

- Branch Manager: ₹10-12 LPA

Senior-Level Positions (10+ years experience):

- General Manager: ₹18-25 LPA

- Deputy Managing Director: ₹25-35 LPA

- Zonal Head: ₹20-30 LPA

Additional Benefits:

- Job security and stability

- Comprehensive health insurance

- Retirement benefits and pension

- Housing and travel allowances

- Opportunities for further education and training

Success Stories: Real Examples

Case Study 1: Rajesh Kumar, BSc Agriculture graduate from Haryana, cleared IBPS AFO in 2019. Starting as an Agricultural Field Officer, he was promoted to Assistant Manager within 3 years due to his exceptional understanding of local farming practices and successful loan recovery rates.

Case Study 2: Priya Sharma, BSc Horticulture graduate, cleared NABARD Grade A in 2020. She now works on policy formulation for organic farming initiatives and has been instrumental in designing microfinance products for women farmers.

Overcoming Common Challenges

Challenge 1: Competition from Non-Agriculture Graduates

Solution: Highlight your domain expertise and practical understanding of agricultural issues during interviews.

Challenge 2: Adapting to Banking Terminology

Solution: Start reading banking and financial newspapers regularly. Take online courses on banking fundamentals.

Challenge 3: Balancing Preparation with Other Commitments

Solution: Create a structured study plan with specific time slots for each subject. Use weekends for intensive practice sessions.

Government Exams for Agriculture Graduates Beyond Banking

While focusing on banking exams, consider these alternative career paths:

- FCI Assistant General Manager: Food Corporation of India

- ICAR NET: For lectureship and research opportunities

- State PSC Agricultural Officer: Various state governments

- UPSC Civil Services: With Agriculture as optional subject

Latest Trends in Agricultural Banking

The agricultural banking sector is evolving rapidly with:

- Digital Banking Solutions: Mobile apps for farmers and rural communities

- Fintech Integration: Technology-driven agricultural lending

- Sustainable Finance: Green loans and climate-smart agriculture funding

- Data Analytics: Using technology for risk assessment in agricultural lending

Understanding these trends will give you an edge in interviews and actual job performance.

Frequently Asked Questions (FAQs)

Your Next Steps: Action Plan

Immediate Actions (Week 1-2):

- Research and choose 2-3 target exams based on your interests

- Collect syllabus and exam patterns for chosen exams

- Gather study materials and resources

- Create a 6-month preparation timeline

Short-term Goals (Month 1-3):

- Complete foundational topics in quantitative aptitude and reasoning

- Strengthen English language skills

- Start reading banking and agricultural current affairs daily

- Take diagnostic tests to assess your current level

Long-term Goals (Month 4-6):

- Focus on professional knowledge and specialized topics

- Take regular mock tests and analyze performance

- Revise weak areas and practice time management

- Stay updated on exam notifications and application deadlines

Conclusion: Your Banking Career Awaits

Pursuing banking exams after BSc Agriculture opens doors to a rewarding career that combines financial expertise with agricultural knowledge. The banking sector needs professionals who understand rural economies, agricultural challenges, and farming communities.

Your BSc Agriculture degree is not just a qualification—it’s your competitive advantage in a sector that’s actively seeking domain experts. Whether you choose IBPS AFO for direct field work, NABARD Grade A for policy-level positions, or IBPS PO for comprehensive banking experience, each path offers excellent growth prospects and the opportunity to make a meaningful impact on rural development.

The journey may seem challenging, but remember that your agricultural background gives you a unique perspective that general graduates lack. Use this advantage, prepare systematically, and stay committed to your goal.

Ready to start your banking career journey? Visit our blog regularly for the latest exam notifications, preparation strategies, and success stories from agriculture graduates who’ve successfully transitioned to banking careers. Your future in banking starts with the decision to take that first step today.

Subscribe to our newsletter for weekly updates on banking exams, study materials, and career guidance specifically tailored for agriculture graduates. Together, let’s build a successful banking career that leverages your agricultural expertise.

Read Also:

Leave a Reply